Buying a home on a limited income might seem daunting, but with the right approach and knowledge of available resources, it’s entirely possible. Low-income doesn’t have to stand in the way of homeownership.

In fact, there are several government-backed and private loan programs designed specifically to help low-income earners qualify for a mortgage.

If you’re wondering how to make that dream a reality, this guide will walk you through the key steps.

Assess Your Financial Situation

The first step toward qualifying for a mortgage is understanding where you stand financially.

Take a detailed look at your income, monthly expenses, existing debt, and credit score. Lenders typically evaluate these factors to determine your eligibility. A lower debt-to-income ratio (ideally below 43%) and a stable source of income will boost your chances of approval.

If your credit score is on the lower side, don’t worry. Many low-income mortgage programs accept applicants with average or even fair credit. However, improving your score before applying can help you qualify for better terms.

Explore Mortgage Programs for Low-income Borrowers

There are several mortgage programs specifically designed to help people with limited income purchase a home. These include:

-

FHA Loans: Insured by the Federal Housing Administration, these loans are known for their lenient credit requirements and low down payments (as low as 3.5%).

-

USDA Loans: For eligible rural and suburban buyers, USDA loans require no down payment and offer low interest rates.

-

VA Loans: If you’re a veteran or active-duty service member, VA loans offer excellent terms including zero down payment and no private mortgage insurance.

-

State and Local Assistance Programs: Many states offer grants, down payment assistance, or second mortgage programs for low-income homebuyers.

Each of these options has different criteria, but all are tailored to help low-income individuals or families qualify for a mortgage.

Get Pre-Approved

Pre-approval gives you a clear picture of how much a lender is willing to let you borrow. It also strengthens your position when negotiating with sellers. During pre-approval, lenders will evaluate your income, employment history, credit report, and financial documents.

To increase your chances of getting pre-approved for a low income home loan, be ready with proof of steady income, tax returns, bank statements, and information about your debts. To find more information how to qualify or get pre-approved, you can read detailed instructions on AmeriSave.

Save for a Down Payment

While many low-income mortgage programs offer low or even zero down payment options, having some savings can improve your application. It also helps cover other costs like inspections, closing fees, or initial repairs. Even saving a small percentage of the home’s price can make a big difference in your loan terms and approval odds.

Consider a Co-Borrower

If qualifying on your own proves difficult, applying with a co-borrower can improve your chances. Their income and credit will be considered alongside yours, increasing the total income available for mortgage qualification.

Just keep in mind that both parties will be equally responsible for the loan.

Work with a Housing Counselor

Free or low-cost housing counseling services are available through HUD-approved agencies. A counselor can help you understand your mortgage options, improve your credit, and create a budget to prepare for homeownership. They can also guide you through the application process and help identify the best low-income home loan program for your situation.

ABOUT THE AUTHOR

Aleksandra Djurdjevic

Senior Content Creator

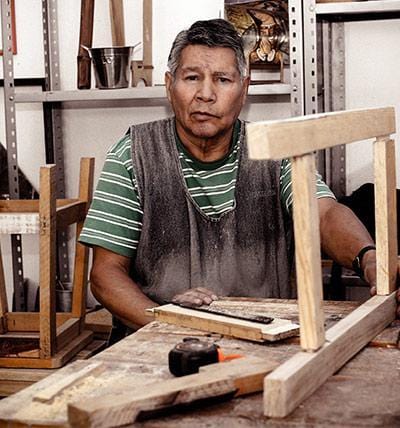

Aleksandra Djurdjevic is a senior writer and editor, covering jewelry, accessories, and trends. She’s also works with services, home décor. She has previously worked as ESL teacher for English Tochka. Aleksandra graduated from the Comparative Literature department at the Faculty of Philosophy in Serbia. Aleksandra’s love for the environment, crafts and natural products over the years helps her continue to be a top expert at Wooden Earth.