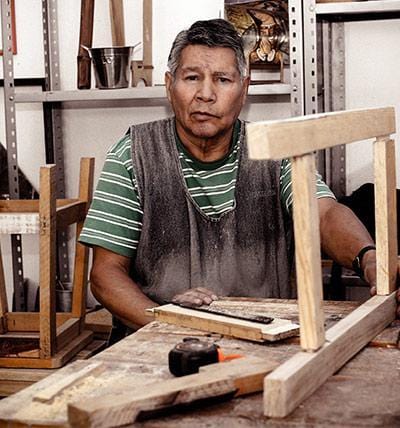

Running a woodworking business or managing it as a side hustle can be as fulfilling as it is challenging, especially when tax season rolls around.

Navigating the maze of taxes might not be as exciting as turning a piece of wood into a masterpiece, but it's just as essential.

Knowing how to leverage tax relief strategies can save you money and reduce your tax burden, making your craft more profitable and much less stressful.

This guide will delve into effective tax strategies specifically tailored for woodworking entrepreneurs.

Deducting Operating Expenses

One of the most immediate ways to manage your tax liabilities is by deducting operating expenses.

Every cent you spend on your woodworking business—from the cost of raw materials like wood and finishes to the tools and machinery needed to create your products—can be deducted. Understanding what's deductible and keeping meticulous records are key.

Start by keeping track of all purchases with receipts or digital records. Whether it's a new bandsaw or a box of nails, each item purchased for business use can reduce your taxable income. Additionally, you may qualify for a home office deduction if your woodworking space is based at home. This includes a portion of costs related to your home, like mortgage interest, insurance, utilities, and repairs, based proportionally on the size of your home office compared to your home's total space.

Utility costs for your workshop can also be significant, especially if you use power-hungry equipment. Keep detailed records of your electricity bills, especially if your workshop is separate from your home. If it's impossible to separate personal and business utility use, a reasonable percentage can be used based on your workshop's square footage versus your home's total square footage.

Capitalizing on Depreciation

Woodworking equipment can be expensive; thankfully, you don't have to bear the full financial weight in the year of purchase. Depreciation is a tax relief strategy that allows you to spread the cost of your equipment over its useful life. This reduces your annual tax bill and aligns the expense recognition with the income your investments help generate.

When you buy a new piece of equipment, consult the IRS guidelines or a tax professional to determine the best depreciation method. The Modified Accelerated Cost Recovery System (MACRS) is commonly used because it accelerates depreciation, offering more significant deductions in the early years of an asset's life. For instance, if you purchase a new woodworking machine for $5,000, you can depreciate it over five years, reducing your taxable income by $1,000 annually if using straight-line depreciation.

Special provisions like Section 179 may allow you to immediately deduct the full cost of certain property types in the year they are placed in service rather than depreciating them over several years. This can be particularly beneficial for small businesses that need immediate tax relief to maintain cash flow.

Beyond deductions and depreciation, several tax credits and incentives can benefit woodworking businesses. For example, if you hire employees or apprentices to help in your workshop, you might qualify for the Work Opportunity Tax Credit. This credit is designed to encourage the employment of people from certain groups, such as veterans or the long-term unemployed.

Investing in energy-efficient equipment can also yield tax credits. Suppose you upgrade your workshop with energy-saving systems or renewable energy solutions, like solar panels. In that case, you might be eligible for credits that can reduce the amount of tax you owe dollar for dollar.

Another aspect to consider is state-specific incentives. Some states offer additional tax benefits for small businesses, including reduced tax rates, exemptions, or credits for local property taxes if your workshop qualifies as a small business property.

Navigating Sales Tax for Woodworking Products

Understanding and correctly handling sales tax is crucial for woodworking businesses, especially those selling products directly to consumers. Each state has its rules regarding sales tax, and the rates can vary widely, not just by state but also by county and city. For woodworkers, this means determining whether the products they sell are taxable and, if so, at what rate, depending on the buyer's location.

Register for a sales tax permit in the state where you operate. This is typically required before you make any sales. Once registered, you'll be responsible for collecting the correct sales tax amount at the point of sale. For online sales, this might require setting up your website's checkout process to automatically calculate and add sales tax based on the buyer’s location. Keeping track of these collections is vital, as you'll need to report and remit them to the appropriate tax authority regularly, usually monthly or quarterly.

For those operating in multiple states, consider the implications of 'nexus,' which refers to a business presence that triggers the obligation to collect and remit sales tax in that state. Recent changes in laws, such as those following the South Dakota v. Wayfair, Inc. decision, mean that even businesses without a physical presence in a state could have sales tax nexus if they have a significant volume of sales or transactions there.

Implementing Proper Record-Keeping Techniques

Effective record-keeping is the backbone of any successful tax strategy for a woodworking business. Accurate records ensure that you can take full advantage of tax deductions and credits while also maintaining compliance with IRS requirements. Start by setting up a dedicated accounting system to track all your financial transactions, from raw material purchases to sales revenue. Software solutions like QuickBooks or Xero are designed for small business owners and can be very helpful.

Keep detailed records of every transaction, including the date, amount, and purpose. For expenses, retain receipts or other proof of purchase. For sales, maintain copies of invoices and receipts provided to customers. It’s also wise to track the hours you spend on your business, as this can be important for justifying home office deductions and other business-related expenses.

Organize your documents by category and year, making it easier to retrieve them during tax season or in case of an audit. Reviewing these records can help you stay on top of your business's financial health and spot potential issues early. Additionally, consider having a quarterly review with a tax professional to ensure that your record-keeping aligns with tax planning strategies.

Leveraging Local and Community Resources

Many local and community resources are available to woodworking business owners to assist with tax planning and general business management. Look into small business development centers (SBDCs), local Chamber of Commerce branches, and community workshops. These organizations often provide free or low-cost training and consulting services to help you understand business tax obligations and planning strategies.

Networking with other local business owners can also provide insights and tips on managing business taxes effectively. Many communities have networking groups specific to the trades or small business sectors. Participating in these can give you a wealth of collective knowledge and resources.

Additionally, explore any local grants or funding opportunities available to small businesses. Some regions offer financial assistance or incentives for small businesses to help cover costs associated with technology upgrades, training, or expansion, which could indirectly reduce your tax liabilities by offsetting upfront costs.

By taking advantage of these local and community resources, you can gain valuable knowledge and support that will help ensure your woodworking business meets its tax obligations and thrives in an increasingly competitive market. Finally, if you feel stuck and need help, consider looking into any of the best tax relief companies!

ABOUT THE AUTHOR

Aleksandra Djurdjevic

Senior Content Creator

Aleksandra Djurdjevic is a senior writer and editor, covering jewelry, accessories, and trends. She’s also works with services, home décor. She has previously worked as ESL teacher for English Tochka. Aleksandra graduated from the Comparative Literature department at the Faculty of Philosophy in Serbia. Aleksandra’s love for the environment, crafts and natural products over the years helps her continue to be a top expert at Wooden Earth.