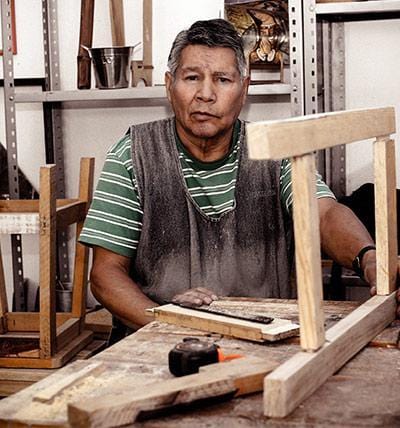

Starting a woodworking business as a Limited Liability Company (LLC) is an exciting venture that involves creativity, craftsmanship, and entrepreneurial spirit. Amid the joy of crafting wood into beautiful creations, it's crucial not to overlook the business side of things, particularly the financial aspect.

One of the foundational steps in establishing a woodworking LLC is selecting the right bank accounts that align with the industry's unique needs. This guide will explore the essential considerations for choosing the best bank accounts for LLCs in the woodworking sector, ensuring a solid financial foundation for your business.

Understanding the Importance of Business Banking for Woodworking LLCs

Establishing separate bank accounts for your woodworking LLC is not just a bureaucratic formality; it's a strategic move that streamlines financial management, enhances professionalism, and clearly distinguishes between personal and business finances. Here are some key reasons why dedicated business banking is crucial for woodworking LLCs:

Legal Compliance

Operating with dedicated business accounts helps maintain the legal separation required for LLC status. This separation is essential for preserving limited liability protection, ensuring that your assets are shielded in case of business liabilities.

Financial Organization

Woodworking businesses involve various transactions, from purchasing raw materials to selling finished products. Having separate accounts allows for better organization, making tracking income, expenses, and tax-related transactions easier. This organization is especially beneficial during tax season.

Professional Image

A professional image is crucial when dealing with clients, suppliers, or financial institutions. Business bank accounts with the LLC's name create a more polished and credible appearance, instilling trust and confidence in your woodworking enterprise.

Financial Management

Dedicated business accounts provide woodworking LLCs with tools and features tailored to business needs. This includes expense tracking, invoicing, integration with accounting software, and simplifying financial management tasks.

Choosing the Right Bank Accounts for Woodworking LLCs

Now that we understand the importance of business banking let's delve into the key considerations for selecting the best bank accounts for woodworking LLCs:

Business Checking Account

A business checking account is the fundamental building block for any woodworking LLC. This account is essential for handling day-to-day transactions, such as purchasing materials, paying suppliers, and receiving payments for your crafted wood products. Look for an account with low fees, ample transaction limits, and online banking capabilities.

Savings Account for Working Capital

Woodworking businesses may face fluctuations in demand and seasonal variations. A business savings account can serve as a designated space to accumulate working capital. It allows you to set aside funds for future material purchases, equipment upgrades, or unforeseen expenses while earning some interest.

Merchant Services Account

If your woodworking LLC sells products directly to customers, whether through a physical store or an online platform, having a merchant services account is crucial. This account enables you to accept credit card payments, providing convenience to customers and expanding your sales opportunities.

Business Credit Card

A business credit card tailored for woodworking enterprises can be a valuable asset. It allows you to separate personal and business expenses while providing a revolving line of credit. Look for a card with rewards or cashback options, and carefully manage credit usage to build a positive credit history for your LLC.

Online Banking Features

In the digital age, online banking is a necessity.

Choose a bank that offers robust online banking features, including mobile banking apps, secure account access, and the ability to manage transactions remotely. This is especially important for woodworking businesses that may operate from diverse locations.

Business Loans and Lines of Credit

While not a traditional bank account, having a relationship with a bank that offers business loans and lines of credit is advantageous. This relationship can be beneficial when your woodworking LLC requires additional capital for expansion, equipment purchases, or navigating temporary financial challenges.

Considerations for Selecting a Business Bank

Fees and Charges

Carefully review the fees associated with business bank account for LLC. Look for accounts with reasonable monthly fees, transaction fees, and ATM charges. Some banks may offer fee waivers based on certain criteria, so explore your options to minimize costs.

Accessibility

Consider the accessibility of the bank's branches and ATMs, especially if you operate a physical storefront. Additionally, assess the availability and functionality of online and mobile banking platforms, ensuring they align with the needs of your woodworking business.

Account Management Tools

Evaluate the account management tools offered by the bank. This includes features such as online invoicing, expense tracking, and integration with accounting software. These tools can significantly streamline financial management tasks for your woodworking LLC.

Customer Support

Reliable customer support is crucial for addressing any issues or queries promptly. Choose a bank that provides excellent customer service and offers support channels that suit your preferences, whether it's phone, email, or live chat.

Interest Rates

For savings accounts and certificates of deposit (CDs), consider the interest rates offered by the bank. While business savings accounts may not have as high-interest rates as personal accounts, every bit of interest earned can contribute to your Woodworking LLC's financial growth.

Conclusion

In the intricate world of woodworking, where precision and craftsmanship meet business acumen, choosing the right bank accounts is a foundational step toward success.

Woodworking LLCs can ensure legal compliance, enhance financial organization, project a professional image, and streamline financial management by opting for dedicated business banking. The considerations outlined for selecting specific accounts and choosing a business bank underscore the importance of a strategic approach to financial infrastructure. Building a strong financial foundation through well-suited bank accounts positions your woodworking LLC for sustainable growth and prosperity in the competitive industry of artisanal craftsmanship.

ABOUT THE AUTHOR

Nurlana Alasgarli

Content Specialist

Nurlana Alasgarli is a professional copywriter with more than 6 years of creative writing experience. Having lived and experienced all over the world, there are many writing genres that Nurlana follows, including nature, arts and crafts and the outdoors. Nurlana brings life to content creation, captivating her readers.